Category: News

What the End of the De Minimis Rule Means for UK Exporters Shipping to the US

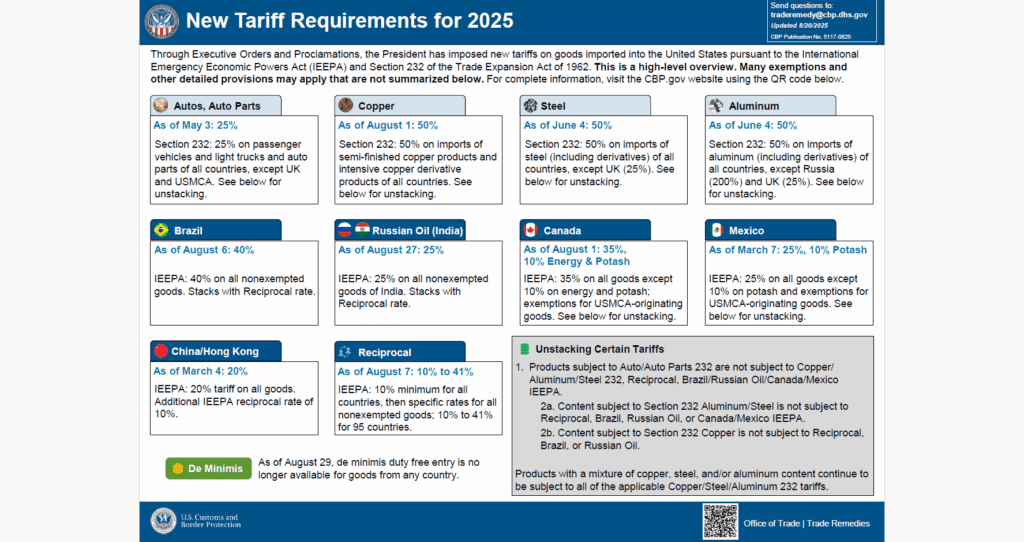

The recent end of de minimis tariff exemptions in the United States has set off alarm bells across global retail. While much of the commentary has focused on the impact to Asian manufacturing powerhouses, UK exporters are also bracing for change. With the rule change that came into effect on 29 August, shipments under $800 entering the American market are no longer exempt from duties or fees. For UK brands, this shift carries major implications, especially in the e-commerce, direct-to-consumer (DTC), and online fashion sectors.

Why UK Retailers Are Paying Attention

Analysis from retail tech communications provider Flagship shows that UK search interest in “Trump Tariffs” surged by 90% in late August as British fashion retailers and marketplace sellers scrambled to understand the new trade environment. Flagship also reported that searches for “de minimis rule” spiked 52.5% in the week leading up to the deadline, while searches for “US tariffs” climbed 78.9% compared with two weeks prior.

The scale of the UK’s exposure to this policy change is significant. According to Flagship, 41 million de minimis shipments entered the US from the UK last year, making the UK the fourth-largest sender of low-value parcels after China (944 million), Canada (98 million), and Mexico (94 million).

Immediate Cost Pressures

The new structure places flat fees of $80 to $200 per shipment for the first six months, according to the US administration. For small to mid-sized retailers, particularly in fashion and lifestyle goods, this creates a margin squeeze at a time when competition is already intense. The narrow window between announcement and enforcement—just over a month—also left little time for businesses to adapt pricing models or customer communications.

Strategic Shifts Underway

Uncertainty remains, particularly after a recent Court of Appeals ruling challenged the legality of the tariffs. Still, exporters cannot afford to wait on the outcome of a potential Supreme Court review. Data cited by Flagship from Retail Economics indicates that 76% of UK exporters are already diversifying away from the US, with the Middle East and North Africa (MENA) region—especially the UAE—emerging as attractive growth markets.

This trend reflects a broader need for resilience in cross-border trade strategies. Relying too heavily on any one market leaves businesses vulnerable to sudden regulatory or policy changes.

How Freight Forwarders Can Support Retailers

At Future Forwarding, with offices in both the UK and the US, we see this policy shift as more than just a disruption—it is a call to action. Exporters need reliable partners who can help them:

- Navigate Tariff Complexities: Understanding new fee structures and ensuring compliance is essential to avoid unexpected penalties.

- Re-evaluate Supply Chains: Reviewing origin points, distribution hubs, and last-mile strategies can mitigate additional costs.

- Explore New Markets: Expanding into alternative geographies requires freight forwarding expertise, local knowledge, and trusted carrier relationships.

- Stay Agile: With trade policy in flux, building flexible logistics networks enables companies to pivot quickly when conditions change.

Looking Ahead

The end of the de minimis exemption is a stark reminder that global trade is not static. Exporters who adapt quickly—by diversifying markets, re-engineering supply chains, and working with freight partners who provide proactive guidance—will be best placed to maintain competitiveness.

Future Forwarding remains committed to helping UK and US clients navigate these shifts with clarity, agility, and a focus on long-term growth.